NEW REPORT

Overcoming Ransomware

As the insurance industry reels from ransomware, At-Bay has helped businesses stay secure year-round through a combination of technical underwriting and active risk monitoring. The result is a dramatic reduction in ransomware in At-Bay’s portfolio. In this report, we share our blueprint for thriving in a digital world.

Download your copy

Overcoming Ransomware: A Blueprint for Thriving in a Digital World

Did you know active risk monitoring reduces ransomware attacks by 7x? Download the full report to learn how At-Bay is overcoming ransomware.

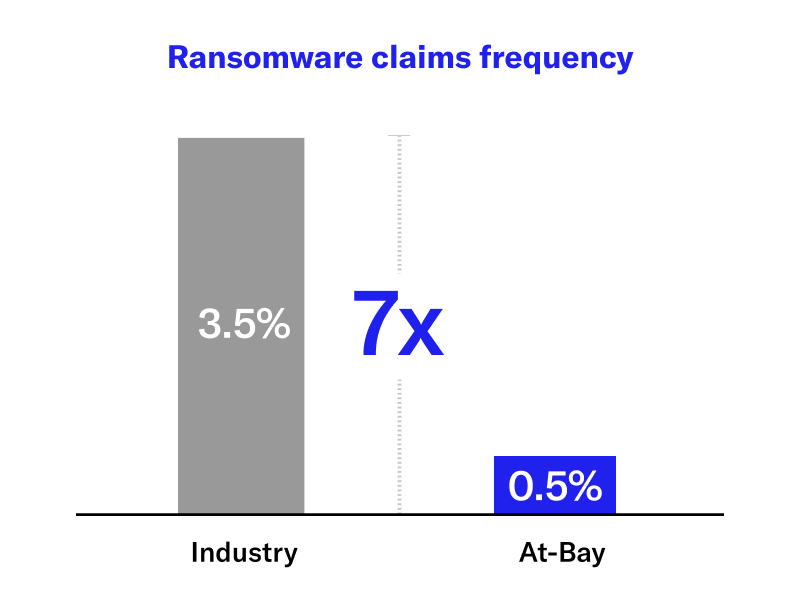

Ransomware Claims Frequency 7x Below Average

Active risk monitoring is a combination of frequent scans to detect new threats and an in-house security team to help businesses and brokers quickly resolve issues. Active risk monitoring has helped reduce the frequency of ransomware attacks in At-Bay’s portfolio to seven times below industry average.

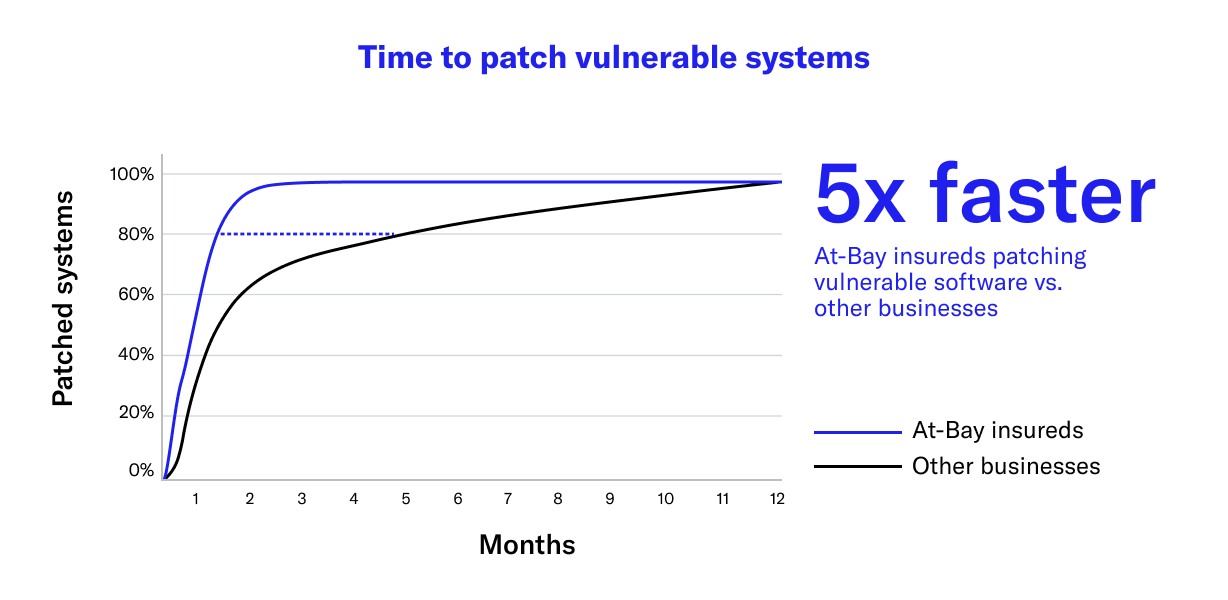

Expedite Software Patching by 5x

Active risk monitoring allows At-Bay to detect new software vulnerabilities before they are exploited. Through active risk monitoring, At-Bay insureds remediate vulnerable software five times faster than other businesses.

Read the report now

Download the full report to learn how At-Bay is overcoming ransomware.