Tech E&O Insurance

Don’t settle for professional liability coverage by endorsement. At-Bay’s Technology Errors & Omissions insurance policies are specially designed to address the key risks that technology companies face in the market.

Tech E&O insurance protects businesses from financial loss and liability claims arising from an organization’s technology products or services.

Tech E&O Coverage Highlights

- Breach of contract coverage expanded beyond standard technology liability existing in absence of a contract

- No exclusions for breach of warranties, guarantees, or consequential damages

- Broad intellectual property infringement coverage extended to trade secret misappropriation, cybersquatting, improper deep-linking, and source-code license violations, as well as standard software copyright infringement

- Service credits included within the definition of payable damages if issued to settle a claim

- Personal injury coverage includes defamation, malicious prosecution, wrongful eviction, and false imprisonment

- Comprehensive negligence coverage, including improper installations, coding errors, data processing flaws, failed implementations, and network outages

- Contractual indemnity coverage for obligations owed to customers resulting from alleged wrongful acts

- All Tech E&O policies enhanced with our active risk monitoring services at no additional cost

Up to

$10M

In limits

Up to

$5B

In revenue

Primary & Excess Appetite

At-Bay's Tech E&O product offers up to $10 million in limits to businesses up to $5 billion in revenue for both primary and excess products, in most classes of business.

*At-Bay does not insure businesses in the gambling, cannabis, and adult entertainment industries.

At-Bay Stance: Proactive Security at Your Fingertips

These security services are included as part of surplus Cyber or Tech E&O insurance policies with At-Bay.*

At-Bay Stance

At-Bay Stance provides mission-critical products and services that reduce cyber risk by identifying and prioritizing threats. Worth thousands of dollars, customers get it all for just a small fee included in their policy.

Learn more

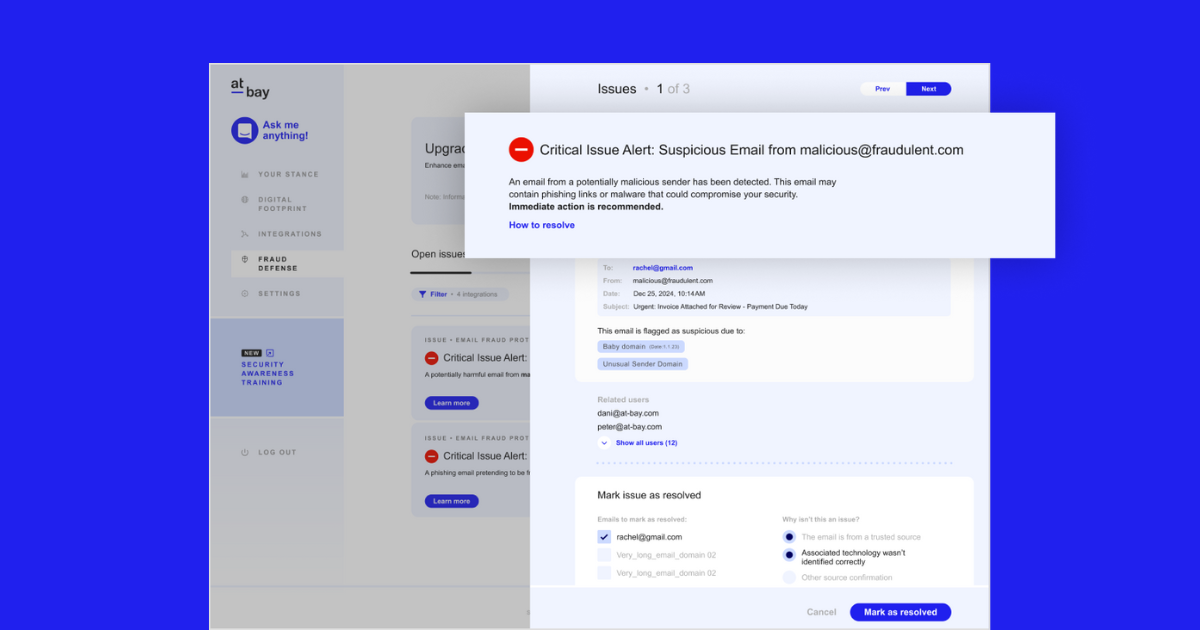

Stance Fraud Defense

Fraud Defense adds a layer of AI-powered email security that monitors employee inboxes and protects businesses from costly financial fraud.

Learn more

Stance Advisory Services

Advisory Services is At-Bay’s on-demand team of security experts who can help prioritize risks, resolve issues, and design better security controls.

Learn moreWhat’s Your Cyber Risk?

Quickly determine your client's financial exposure to a cyber attack with our cyber risk calculators.

Level Up on Tech E&O

Insights and learnings to empower brokers to be an expert on Tech E&O.

Frequently Asked Questions

-

Which higher-risk business classes are eligible for Tech E&O auto-quotes?

We provide auto-quotes and competitive rates for technology businesses up to $5 million in revenue in the following classes: emergency notification, financial software, healthcare/medical software, data destruction/e-recycling, and business process outsourcing.

Read More -

Can I use the Broker Platform for technology businesses larger than $25M in revenue?

Yes. The quote won’t be generated automatically, but one of our underwriters will review the submission quickly and offer terms if it is within our appetite. The long-form application won’t be required unless deemed necessary by the underwriter.

Read More -

Can I offer my retail agents exclusive access to get bindable Tech E&O auto-quotes with At-Bay?

Yes. We understand brokers work with retailers who often quote SME technology business directly, so this is a great way to give them a rare, quick-quote solution for Tech E&O without sacrificing on coverage. To get a branded platform iteration via White Label or discuss our API offering, email partnerships@at-bay.com.

Read More