Thriving in a Digital World

As the insurance industry reels from ransomware, At-Bay has helped insureds stay secure through a combination of technical underwriting and active risk monitoring.

The result is a dramatic reduction in ransomware in At-Bay’s portfolio compared to the industry.

Read on to learn more.

Overcoming Ransomware

Cyber risk breaks fundamental insurance assumptions. To meet the dynamic threat of cyber, we redesigned the insurance operating system by combining technical underwriting with active risk monitoring to help businesses stay secure year-round. Download the full report to learn how At-Bay is overcoming ransomware.

Fill Out the Form to Download the Report

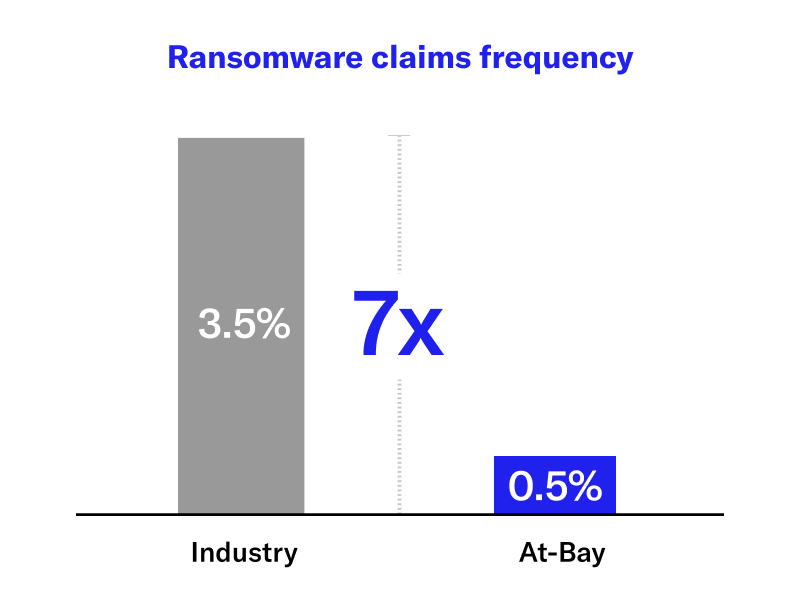

Ransomware Claims Frequency 7x Below Average

Active risk monitoring is a combination of frequent scans to detect new threats and an in-house security team to help businesses and brokers quickly resolve issues. Active risk monitoring has helped reduce the frequency of ransomware attacks in At-Bay’s portfolio to seven times below industry average.

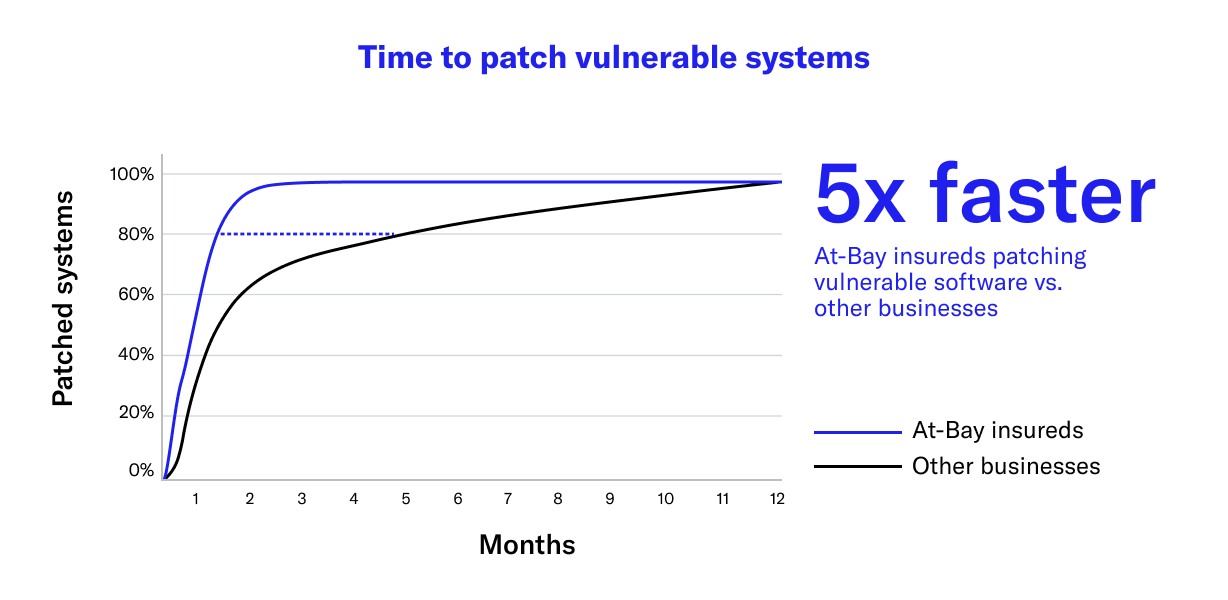

Expedite Software Patching by 5x

Active risk monitoring allows At-Bay to detect new software vulnerabilities before they are exploited. Through active risk monitoring, At-Bay insureds remediate vulnerable software five times faster than other businesses.

A Technology Platform for Brokers

Insurance for the digital age means innovating the business of insurance. Our automated underwriting platform enables you to get bindable quotes in seconds, along with clear and actionable security insights to help your clients.

Start Quoting Now-

Fully automated underwriting

-

Bindable quotes in seconds

-

Actionable security insights