Cyber Insurance

At-Bay’s cyber insurance policies provide robust first- and third-party coverage on both primary and excess lines. Our policies are enhanced with Active Risk Monitoring services at no additional cost and supported by our in-house Claims team.

Cyber Coverage Highlights

- Direct and Contingent coverage for Business Interruption and System Failure

- Social Engineering & Invoice Manipulation coverage available for all classes of business

- Full limits offered for Cryptojacking and Bricking coverage

- Broad Cyber Extortion coverage including payment of cryptocurrencies

- Reputational Harm coverage including PR costs as a result of Adverse Publications

- Ability to manuscript endorsements to address specific exposures for the insured

- Comprehensive Information Privacy coverage includes the unintended violation of any Privacy Regulation, including GDPR & CCPA

- All policies are enhanced with our active risk monitoring services, at no additional cost*

- Surplus paper available via Broker Platform and API

Up to

$10M

In limits

Up to

$5B

In revenue

Surplus Cyber Appetite

At-Bay's Surplus Cyber product offers coverage for businesses with up to $5 billion in revenue and up to $10 million in limits on both a primary and excess basis for most classes of business. Through our Broker Platform, brokers can get quotes in seconds for businesses with up to $100 million in revenue and up to $3 million in limits.

At-Bay Stance: Proactive Security at Your Fingertips

These security services are included as part of surplus Cyber or Tech E&O insurance policies with At-Bay.**

At-Bay Stance

At-Bay Stance provides mission-critical products and services that reduce cyber risk by identifying and prioritizing threats. Worth thousands of dollars, customers get it all for just a small fee included in their policy.

Learn more

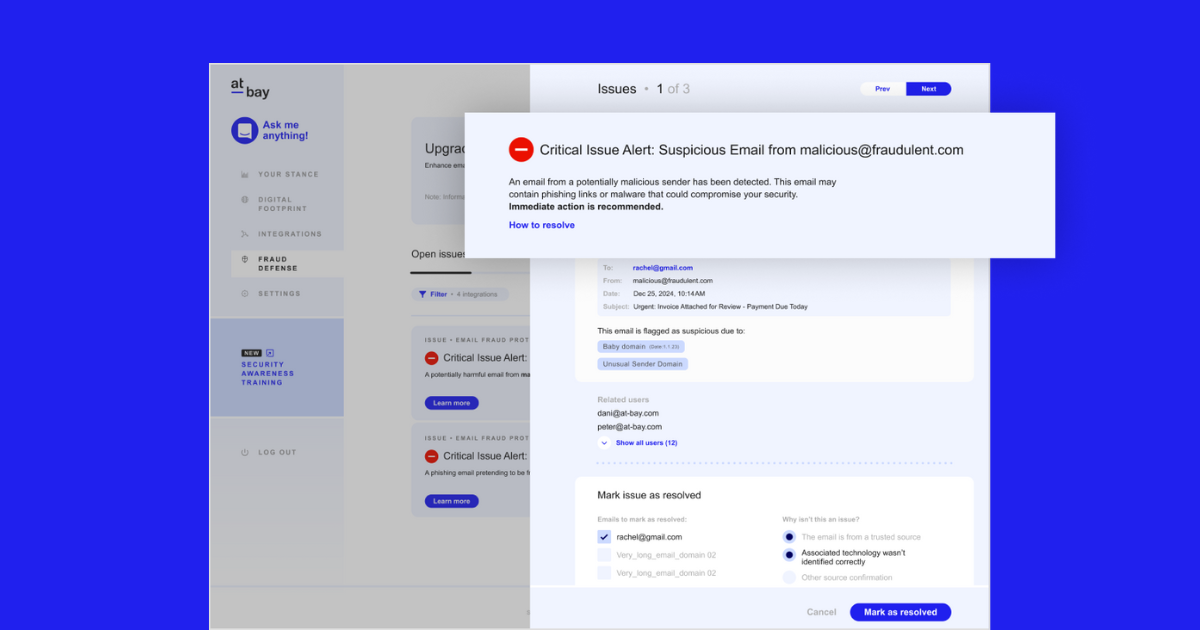

Stance Fraud Defense

Fraud Defense adds a layer of AI-powered email security that monitors employee inboxes and protects businesses from costly financial fraud.

Learn more

Stance Advisory Services

Advisory Services is At-Bay’s on-demand team of security experts who can help prioritize risks, resolve issues, and design better security controls.

Learn moreWhat’s Your Cyber Risk?

Quickly determine your client's financial exposure to cyber attack with our cyber risk calculators.

Level Up on Cyber

Insights and learnings to empower brokers to be an expert on cyber.

Frequently Asked Questions about our Cyber Coverage

-

Does At-Bay offer system failure coverage?

Yes! At-Bay offers both direct and contingent system failure coverage to the full limit of insurance by default, regardless of whether you send submissions online or through email.

Read More -

Does At-Bay offer reputational harm coverage?

Yes! At-Bay offers reputational harm coverage to the full limit of insurance by default, regardless of whether you send submissions online or through email.

Read More -

What if my client's industry isn't listed on the At-Bay application?

If your client's industry isn't listed on our submission form, don't fret!

Read More