Article

Why We Built InsurSec Packages (And Why Your Clients Need Them)

At-Bay’s solution to the SMB security gap

Financial fraud and ransomware are the two biggest cyber threats facing businesses today. As reported in our 2025 InsurSec Rankings Report, nearly 60% of At-Bay cyber claims are ransomware or financial fraud, mostly originating from email or remote access.

These attacks are not only growing in frequency and severity, but also the speed and sophistication of these attacks are accelerating. From Q2 to Q3 of 2025, we saw a 300% surge in ransomware attacks involving customers with a SonicWall device, with ransom demands averaging $958K — more than double typical amounts. Attackers moved from initial intrusion to full encryption in an average of one and a half days, with some cases taking less than an hour.

These incidents are symptoms of a much larger problem: Small and medium-sized businesses (SMBs) are facing threats they simply can’t defend against on their own. The tools they’re counting on are failing. The consequences are becoming existential. And traditional approaches to cyber risk aren’t solving the problem.

SMBs Can’t Keep Up, and the Consequences Are Dire

SMBs’ vulnerability to modern cyber threats is a structural market failure, not a skills or budget problem.

Nearly every email security solution we analyzed in our 2025 InsurSec Rankings Report was associated with higher email claims frequency in 2024 compared to 2023. The average claims frequency for businesses using email security solutions increased 53% year-over-year. These security tools, designed to protect against traditional phishing, are being overwhelmed by AI-powered fraud they weren’t built to stop.

The remote access situation is equally concerning. Our claims data shows that businesses using on-premise VPNs were 3.7X more likely to experience ransomware attacks compared to those using cloud-based or no VPN at all. For users of certain vendors like Cisco and Citrix, that risk multiplied to 6.8X — and we’ve already discussed the recent and extreme surge in risk related to SonicWall devices above.

The consequences of this risk extend beyond immediate financial loss, which in itself is substantial: The average funds transferred in a fraud incident hit $286K in 2024, with the largest exceeding $5M. On top of that, there’s business interruption, reputational damage, and class action lawsuits that have become efficient at monetizing mid-market breaches.

For businesses of this size, any cyber incident can be life-threatening or a scarlet letter they may never fully shake.

At-Bay’s Mission: Bringing Insurance and Security Together

We started At-Bay because we saw this protection gap and believed there was a better way. The traditional insurance model doesn’t serve anyone well when threats evolve this rapidly, while the conventional enterprise-focused security model leaves SMBs unable to afford the tools and talent required to defend against modern adversaries.

That’s why we bring insurance and security together to protect vulnerable businesses, not as separate offerings, but as an integrated InsurSec solution. Security actively protects and prevents incidents before they happen. Insurance offers a financial backstop in case an attacker gets through.

Here’s why this works: As an insurance provider, we can track which controls prevent incidents because we have claims data at scale. When that data demonstrates that certain technologies create outsized risk (such as the email vendors or VPNs we mentioned above), we can identify the tools and providers responsible and make our clients aware of the increased risk. When our data points to certain security controls reducing loss frequency and severity, we have empirical proof. This enables us to build security solutions addressing the most pressing risks of the moment, to update them as threat actors evolve their tactics, and to reward clients who adopt them with premium credits or coverage enhancements.

Security So Good We’re Willing to Bet on It

Our data tells us exactly which businesses experience incidents and what happened — which controls were in place, how attackers got in, and what stopped them or allowed them to succeed. We can see clearly that when businesses implement the right security controls, their risk profile changes so dramatically that we can offer insurance enhancements the industry typically doesn’t provide.

We set out to close the widening protection gap for SMBs that can’t rely on security tools that keep failing them, and our InsurSec Packages are the result. These are the first solutions in the market that combine enterprise-grade managed security with breakthrough insurance coverage enhancements to address the two threats driving the majority of our claims: ransomware and financial fraud.

These packages represent a fundamentally different approach to cyber risk. Traditional insurance transfers risk after an incident occurs. Traditional security tries to prevent incidents but leaves businesses exposed when prevention fails. Our InsurSec Packages dramatically reduce the likelihood of an incident through proven Managed Detection and Response (MDR) technology (At-Bay MDR has an incident avoidance rate of 99.999%) and provide superior financial protection when attacks do succeed — protection that is possible precisely because the security controls are in place.

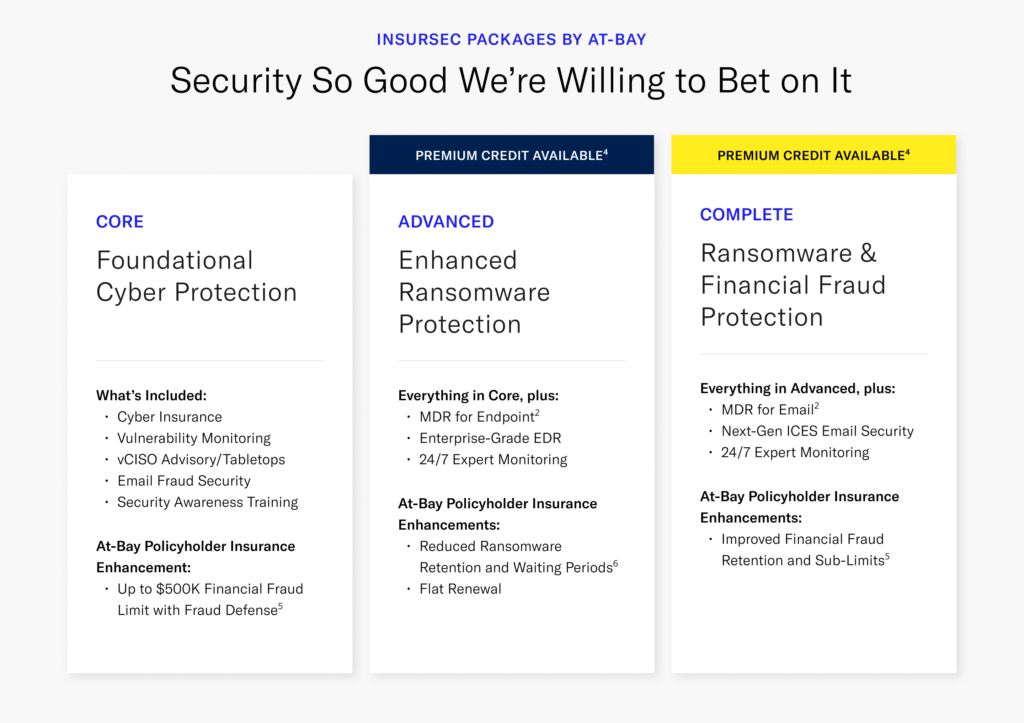

We’ve just launched two new InsurSec Packages in addition to our core offering:

Both packages come with premium credit available, meaning policyholders don’t just get additional coverage enhancements and reduced claims risk, they can see lower policy premiums as well.

These aren’t insurance policies with security bolted on. At-Bay was built from day one with security in our DNA. Our security team is about the same size as our insurance team, a reflection of how fundamentally we believe in the integrated InsurSec approach. Our InsurSec Packages are the result of that philosophy: integrated solutions where each component reinforces the others. Security that reduces incidents, insurance that responds when prevention fails, and enhanced terms reflecting the materially lower risk these controls create.

The cyber threat landscape isn’t getting easier. Attackers are more sophisticated, vulnerabilities are proliferating, and AI is amplifying threats. But by combining financial protection with continuous security monitoring informed by real-world claims data, we can give SMBs the comprehensive protection they need.

A Solution That Can Work With Your Existing Partners

Our InsurSec packages can stand alone, but we know many businesses already work with Managed Service Providers (MSPs) and Managed Security Service Providers (MSSPs) for IT management and security support. At-Bay MDR isn’t designed to replace those relationships, it’s designed to fill a critical gap that many MSPs don’t address: 24/7 threat monitoring and response.

Most MSPs excel at maintaining infrastructure and implementing security tools, but don’t have the around-the-clock Security Operations Center (SOC) required to catch and stop threats in real time. That’s where At-Bay MDR comes in. Our security team can work alongside your existing IT partners, providing the continuous monitoring layer that turns good security tools into active protection.

For MSPs themselves, we’re open to partnership. If you’re an MSP looking to enhance your security offering without building your own 24/7 SOC, At-Bay MDR can help you deliver enterprise-grade protection to your clients while maintaining your core relationship.

Learn More About At-Bay’s InsurSec Packages

If you’re a broker looking to provide clients with truly differentiated protection or a business owner who’s realized that conventional approaches aren’t cutting it anymore, I encourage you to explore what we’ve built. The data is clear about what works. Now it’s time to put it into practice.

1 Based on data from the At-Bay Response & Recovery team

2 Stance MDR is an optional service available for purchase from At-Bay’s security affiliate, is not a requirement for insurance coverage through At-Bay, and is not limited to At-Bay policyholders.

3 Based on At-Bay MDR portfolio performance data from inception through December 15, 2025. Incident avoidance rate calculated by dividing the total number of filed claims by the total volume of verified threats that At-Bay MDR products remediated.

4 Qualified policyholders who implement an approved MDR solution may be eligible for a premium credit. Please contact your authorized insurance representative for additional information concerning potential cost savings. Any premium savings will be based on the specific risk profile of the business.

5 For financial fraud arising from certain causes; see policy for details.

6 The availability of this and all coverage enhancements listed will be based on the specific risk profile of the business and subject to qualifying conditions.